Nifty forms a lower high candle

Pullback rally from the oversold condition in private-sector banks led the market to close positively for the day. Apply neutral strategies that works in this market conditions

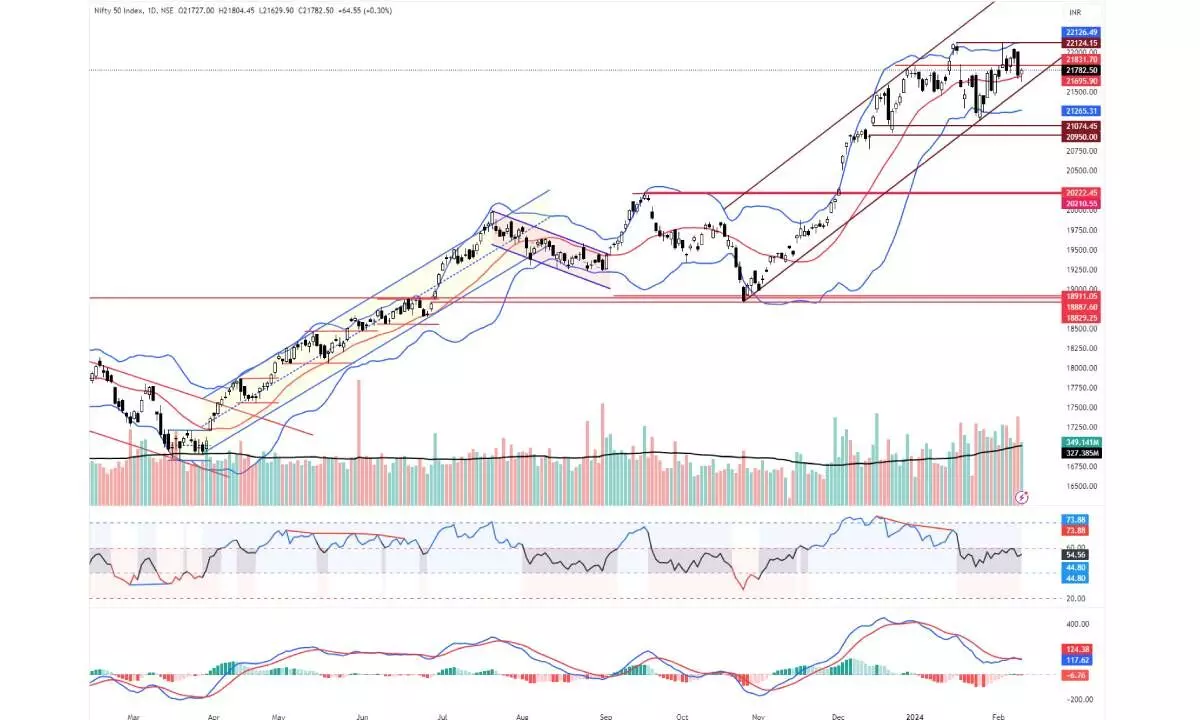

image for illustrative purpose

With the recovery in banking stocks, the benchmark indices closed positive on the weekend. NSE Nifty gained by 64.55 points or 0.30 per cent and closed at 21,782.50 points. Bank Nifty is up by 1.38 per cent. The private-sector bank and PSU bank indices were by one per cent each. The Nifty Pharma and FMCG indices gained by 0.52 per cent and 0.41 per cent, respectively. The PSE and CPSE indices declined by 2.66 per cent and 1.83 per cent, respectively. The Metal index was down by 1.54 per cent, and the Energy index declined by 0.80 per cent. The India VIX is down by 2.40 per cent to 15.45. The market breadth is negative as 1,706 declines and 851 advances. About 159 stocks hit a new 52-week high, and 173 stocks traded in the lower circuit. Yes Bank, HDFC Bank, Zomato, and SBIN were the top trading counters in terms of value.

The pullback rally from the oversold condition in private-sector banks led the market to close positively for the day. As mentioned earlier, the one-day up, another day down kind of moves continue. The Nifty closed negatively on a weekly basis. After hitting a new high, the index has formed a lower high. This week’s move led to a negative divergence in RSI. The 10-week support rose to 21,566 points, which is just 0.97 per cent away. The 20DMA acted as support for the second day. Interestingly, Friday’s positive close on negative market breadth will not be sustainable. Even the cash volumes are much lower. The weekly histogram shows a clear decline in bullish momentum. And the daily histogram showing an increase in bearish momentum clearly indicates waning bullish momentum. With these technical parameters, only a decline below 20DMA, 21695, will be negative. If Friday’s positive bias continues, the index must close above Wednesday’s swing high of 22,053 points for the trend to continue towards another new lifetime high. For now, be on the sideline, as there is no confirmed trend signals. Applying neutral strategies works in this market conditions.